Insurance & Estate Planning

Protecting Your Wealth

Managing the Risk of Long-Term Care

Navigating Policy Pricing

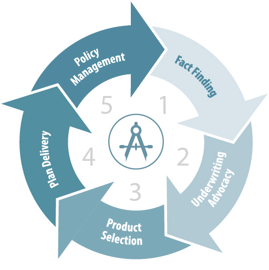

UNDERWRITING ADVOCACY™

A Proactive Approach to Obtaining Favorable Underwriting offers and Policy Pricing

We accomplish this through a proprietary informal underwriting process where we complete 90% of the underwriting BEFORE an application is submitted to an insurance company. This preliminary process enables us to pre-qualify underwriting offers from insurance companies, while protecting your Personal Health Information from the Medical Information Bureau so that your insurability remains unchanged.

As a result, we are able to deliver the best possible underwriting offers to our clients. Once received, the top offers from various companies are analyzed by our team. We match the best underwriting results to the appropriate product and optimized solution. We then discuss all of this information with you so that you can make an informed decision.